german tax calculator in english

Fair taxation Global corporate tax reform is on the way. It is a progressive tax ranging from 14 to 42.

How To Calculate Foreigner S Income Tax In China China Admissions

The German Annual Income Tax Calculator for the 2022.

. It is in German but pretty self-explanatory. The SteuerGo Gross Net Calculator lets you determine your net income. You will most likely get a very high tax refund.

The German Federal Central Tax Office or Bundeszentralamt für Steuern BZSt has set out strict guidelines on how cryptocurrency buying trading and mining is taxed. German Tax categories and german tax law in english. If youre struggling to visualise how all of this affects your income a German tax calculator can give you a good idea of how much money youll actually take home each month.

Try before registering. Your taxable worldwide income in FY 2021 is EUR 300000. Filing your tax return is worth it.

Youll then get a breakdown of your total tax liability and take-home pay. The new procedure for calculating vehicle tax. To get an idea of how much income tax you will have to pay you can use this income tax calculator in German.

German Grossnet Calculator Wage Calculator for Germany. Hundreds of thousands of satisfied customers. Calculate your Gross Net Wage - German Wage Tax Calculator.

Salary Before Tax your total earnings before any taxes have been deducted. The Federal Ministry of Tax has created an online tax calculator. Surcharges on income tax.

This Income Tax Calculator is best suited if you only have income as self employed from a trade or from a rental property. Owes annual German income tax of 2701. The first German tax return in English for all expats.

Register and discover how easy it is to get an average tax refund of more than 1000 Euro online. Just do your tax return with SteuerGo. This is a genuine revolution in international tax law.

The First German Tax Return In English For All Expats. Check in real time how high your return will be. This program is a German Income Tax Calculator for singles as well as married couples for the years 1999 until 2019.

The surcharge is imposed as a percentage on all individual income taxes. You can do your tax return in Germany in English. You can enter your details on Zasta for free and you will get a pre-calculated tax return offer from a.

The calculator covers the new tax rates 2022. Zasta is a different kind of tax software as it serves as a platform to connect you to a professional tax advisor. EUR 12409437 total tax charge income tax SoliZ 4137.

Annual tax return Steuererklärung. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Germany affect your income. Calculate your income tax rate in Germany German only.

Millions of euros in tax refunds for. The german tax calculator is updated for the 202223 tax year. Tax return 2021.

The tax class combination III V is designed so that the sum of the. To calculate the German income tax you owe on your wages you can use the SteuerGo tax calculator. For a quick estimation of whether you should consider a tax class change to 3 and 5 you can use this German tax class calculator.

The tax class combination IV IV statutory rule assumes that the Spouses life partners earn approximately the same amount. Register and discover how easy it is to get an average tax. You are a resident of Germany since 2020 irrespective of you citizenship.

The Tax Class Lohnsteuerklasse or Steuerklassen in German is important in determining the amount of withholding income tax deducted from a salary as well as in determining the value of a number of social benefits for. But if you want to find out how much tax you have to pay get a German friend or colleague and type in your data here. Try it for free.

Zasta translated by Google. Cryptocurrency transactions are subject to Income Tax in Germany. German Income Tax Calculator.

The basic approach was approved by. The German Annual Income Tax Calculator is updated to reflect the latest personal Tax Tables and German Social Insurance Contributions. Since September 2018 in Germany and 2019 in Europe the calculation of motor vehicle tax is based on data obtained by a globally harmonized test procedure for determining the values of pollutant and CO2 emissions known as WLTP Worldwide harmonized Light Duty Test Procedure.

Zasta is a different kind of tax software as it serves as a platform to connect you to a professional tax advisor. The german tax calculator is a free online tax calculator updated for the 2022 tax year. A Tax class combinations.

You can expect a high tax refund. You are required to file a tax return. German Income Tax Calculator Expat Tax.

Unfortunately it is in German only. You can enter the gross wage as an annual or monthly figure. If you receive a salary only as an employee on a German payroll you get.

If you wish to calculate your salary Social Insurance payments and income tax for a differant period please choose an alternate payment period or use the Advanced German Tax Calculator. Our gross net wage calculator helps to calculate the net wage based on the Wage Tax System of Germany. Personal tax allowance and deductions in Germany.

Our grossnet calculator enables you to easily calculate your net wage which remains after deducting all taxes and contributions free of charge. Under the auspices of the OECD 137 countries as of 28 December 2021 have reached an agreement on a fair allocation of taxing rights and a global minimum effective tax at a uniform tax rate of 15. Employees of German companies are normally assigned a tax class by the tax authorities according to various categories.

18014 a savings of 1715 per year. German tax burden for FY 2021. In addition to calculating what the net amount resulting from a gross amount is our grossnet calculator can also calculate the gross wage that would yield a.

How much money will be left after paying taxes and social contributions which are obligatory for an employee working in Germany. Also known as Gross Income. In the results table the calculator displays all tax deductions and contributions to mandatory social insurance on an annual and monthly basis.

They offer the following. July 31 2022 for your 2021 tax return. Tax Calculation Example using an income tax calculator provided by the German Federal Ministry of Finance BMF.

To improve the economic situation and infrastructure for certain regions in need the German government has been levying a 55 solidarity surcharge tax. German Tax Class Calculator. The calculator will produce a full income tax.

This guide breaks down everything you need to know about individual crypto taxes and how you can avoid notices audits and. The German Tax calculator is a free online tax calculator updated for the 2022 Tax Year. Overall tax for the couple when paying tax separately.

Joint couples tax using Steuerklasse 3 and 5. New platforms have appeared the past few years to help expats do their taxes 100 in English. As of 1 January 2021 the application of the solidarity surcharge tax has been substantially.

Register free of charge. Simply enter your annual salary to see a detailed tax calculation or select the advanced options to edit payroll information select different tax states etc. You have to enter both spouses gross salaries and tick the box whether you have children.

This more accurate calculation leads to an. Your hand is really guided step-by-step with the tool in a clean interface.

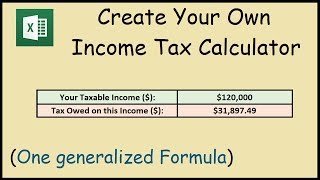

How To Create An Income Tax Calculator In Excel Youtube

Income Tax Calculator For Fy 2021 22 Ay 2022 23 Free Excel Download Commerceangadi Com

German Wage Tax Calculator Expat Tax

German Tax Calculator Easily Work Out Your Net Salary Youtube

How Is Taxable Income Calculated

How To Create An Income Tax Calculator In Excel Youtube